Archive

Still Confusing Family Rust with Silver

As the issue of best use of taxpayers capital again raises its head, a curt reminder of just how good Govts (od any stripe) are at managing projects “owned” by the state is this:

“Radio NZ reports:

When the New Zealand Transport Agency signed off on an integrated national ticketing system in 2009, John Key was prime minister, Avatar ruled at the box office and a pound of butter cost about $3.60.

After more than 16 years, the first stage of the $1.4 billion National Ticketing Solution’s (NTS) latest iteration, known as Motu Move, was launched on Monday in Christchurch, rolling out contactless payment options on bus and ferry services across Greater Christchurch.

The option to pay with contactless debit or credit cards and digital payments like Apple Pay and Google Pay on phones or smart watches on buses and ferries will work on three hundred buses across Christchurch, Waimakariri and Selwyn, but only for those paying full fare.

A system to enable concession holders to pay less and the Motu Move cards themselves have been relegated to later stages.

The entire point of this system is to enable cards which can be programmed with maximum daily fees etc. So basically after 16 years, all they have managed to do is allow 300 buses to take EFTPOS. This is something that you could probably do in around a week, as mobile EFTPOS terminals are very common.

The NTS was slated to be launched in South Canterbury in 2024, but by the middle of this year, Transport Minister Chris Bishop weighed in, saying the project was facing technology, delivery and governance issues and was “not on track”.

Bishop said nothing was “off the table”, as consultants conducted an independent review of the project.”

What would your employment prospects look like if you were this good?

Thanks to David Farrar

The perverse incentives created by Deposit Insurance

The origin of these is well summed up here:

“I can assure you that when you don’t have the full faith and credit of your government you care a lot about the management of systematic risk. I don’t think anyone at Silicon Valley Bank cared about it a damn bit.” (because depositors had deposit insurance – and management could go wild).

A Noisy World

Considering some physics recently I was reminded of the well-established fact that to date at least, all measurement is ever an imprecise business. Measurement is an imperfect act insofar as if the object is to measure one specific phenomenon and that alone – undistorted, without bias, devoid of contaminating adjacent effects, such untouched forms of purity are unattainable,

It is simply the case that the very act of measurement generates “unwanted” intrusions.

Summarised and simplified we have at least:

Systematic Error

- Consistent and predictable bias in measurements.

- Often caused by faulty equipment, calibration errors, or environmental conditions.

An example: A scale that always reads 0.5 kg too high.

- Unpredictable and varies from one measurement to another.

- Caused by human limitations, small fluctuations in experimental conditions, or instrument sensitivity.

- Example: Slight hand tremor affecting stopwatch timing.

Random Error

These errors produce what we conveniently term “noise”. Phenomena which in and of themselves are distinctly separate from and are not that which we seek to measure – but do exist and their presence is captured nonetheless.

Most Significantly

We may be testing or probing to find the presence of (say) a given disease for example. Even where no such disease or symptom thereof exists at all (i.e. patient fit and well – no disease), nonetheless we will measure something. Noise will register in our equipment or otherwise make itself felt in our data.

The trouble is in a great many (most if not all) cases we cannot reliably distinguish the “signal” from the “noise”. We may therefore mistake “absence” for “presence”. No disease but a non-zero reading. We simply do not know with great reliability where noise stops and the phenomena which we are interested in begins.

This is not always simply because of our sloppy ways. The uncertainty principle suggests for instance that even at the most disaggregated of scales we cannot establish both speed of movement and location. One or the other perhaps but both most certainly not. The situation is difficult at other scales as well.

Conclusion

It does strike me therefore that “if we look long enough and hard enough we will find something” but that “something” will not necessarily be anything other than the noise occasioned by measurement.

This effect is worth pondering – notably in medicine and behavioural sciences. In the case of the latter, it may account for the fact that in early days researchers uncovered perhaps five or so cognitive biases. On a recent count Wikipedia claimed to identify 175 or so cognitive biases. Really?

So much for “fair”

The NZ Grocery Commissioner has had a guess at the level of overcharging in NZ supermarkets and come up with two notions of interest:

- the number is likely to be in the “tens of millions of dollars”; and, more dangerously than this idle speculation,

- the idea that overcharged customers should get the entire purchase “free”.

Apart from the fact that Commissioners bear no risk (other than to their reputation) in adopting these god like postures (and their “reckons” should be discounted accordingly), a more interesting point is that if we apply his logic to undercharging – and it seems that the type of errors which sometimes lead to overcharging equally arise with resultant undercharging – with some 18,000 items in a typical supermarket this seems likely – then customers would presumably be charged double the original item’s price if we apply the Commissioner’s logic. He may have some argument of the “they can afford it” variety – but even seen in a kindly light that’s an equity argument of some sort.

Even anecdotal tales do not reveal large numbers of customers reporting under charging let alone offering to make up any shortfall or more. This is surely what we would expect. Why?

- rational self interest without the morals suggests customers should be charged correctly and compensated for any amount overcharged. That is apparently common – certainly that is my experience

- supermarket operators do not, however seem to pursue or harass or even try to find customers who benefit from errors of under pricing (theft is a different animal). Why is it that rational and what does it tell us.

Given that both shop owners and customers are likely to be equally self-interested one conclusion is that they are operating on rather different time scales. Over the long run the shop owner likely has little to gain and a deal of goodwill to lose in trying to recover underpricing error losses. For the customer there is short term gain to reporting over charging (though making a federal case of it on a serial basis may lead to longer term costs).

Both parties then may well be operating rationally. What’s “fair” and what’s “unfair” depends a bit on the time scale being considered. The overall outcome certainly seems to be rational over the bucket of different time frames we all operate in.

It is more difficult to see much logic in wild guesses and back of the envelope compensation schemes applied inconsistently – the incentives for that sort of approach involve a quite different story.

Creating More Emissions while Driving Up Prices

Even first round effects of the proposed agricultural emissions pricing scheme will see:

- Agricultural production shifted abroad to more inefficient, carbon emitting economies given that N.Z. is the lowest carbon emission producer;

- Prices, notably consumer prices for food, will likely increase when substitutes are imported as production falls; and,

- Even existing “Green” treaty commitments specifically state that policies dealing with climate change should be designed such that they do not affect food production.

The logic here does not seem that difficult to understand. Even the politics of the proposed scheme tests rationality severely.

Why reform is demanding

As NZ struggles to reform the RMA, some idea of the impact of NIMBY problems as well as the catyclismic events required to nullify them can gained from this:

The London Blitz and the NIMBYs

by Tyler Cowen December 11, 2021 at 2:16 pm in

NIMBYs can be so bad that they make the London Blitz look good:

We exploit locally exogenous variation from the Blitz bombings to quantify the effect of redevelopment frictions and identify agglomeration economies at a micro-geographic scale. Employing rich location and office rental transaction data, we estimate reduced-form analyses and a spatial general equilibrium model. Our analyses demonstrate that more heavily bombed areas exhibit taller buildings today, and that agglomeration elasticities in London are large, approaching 0.2. Counterfactual simulations show that if the Blitz had not occurred, the concomitant reduction in agglomeration economies arising from the loss of higher-density redevelopment would cause London’s present-day gross domestic product to drop by some 10% (or £50 billion).

Here is the full paper by Gerard H Dericks and Hans R A Koster, via tekl.

Unfortunately and an Eternal Curse

“a salutary lesson [is] that good economics often makes for poor politics. Especially when there is a trust deficit between the key stakeholders and the government; and the politics is partisan and non-consultative.” BBC 20-11-2021

Property Is Not Immediate Realisable Cash Wealth

This is the classic case of illusory wealth. ‘Level and trajectory’ of house prices creating risks for recent buyers – Reserve Bank Financial Stability Report (msn.com)

In the article there are two statements:

- Household wealth has grown by 27% so people have plenty of wealth and ability to withstand shocks. They then say more than half of this is through growth in home values – housing. That’s the RB

- Then Core logic say much the same. People have plenty of scope because their property has risen in value and they are wealthy.

NONE of that is liquid. It is not cash. It depends on

- The housing market staying up there

- Strong liquidity in housing markets

- Willingness of credit providers to take illiquid houses to secure the credit card

BUT

- You cant sell “bits” of houses

- A house takes six (6) weeks to settle…. No money for 6 weeks

- When liquidity drops vendors fix that by selling for less and prices go down

- So attempts to “drive liquidity into the market” reduce prices

The problem then is that lending is secured against illiquid assets which cannot be readily crystallised into cash in a timely fashion.

Property increases may produce a number of things. Immediately Realisable (liquid) Cash is not one of them.

Certainly an Historic Agreement

Global “leaders” (politicians) have reached the momentous decision to increase the tax on “big business” by 15% so as to improve the overall state of the world https://www.rnz.co.nz/news/world/454581/g20-climate-and-covid-19-also-on-agenda-as-world-leaders-meet.

Presumably the resulting revenue will be applied to “good works”. Even in New Zealand (one of the most tax efficient countries) each dollar of revenue raised by tax costs around $1.20 to raise – or “put in a dollar get $0.80”. At the same time there is the minor issue of reducing the incentives, passion and capacity of the world’s most successful enterprises by some significant amount to be ultimately born by their consumers who get to pay for this thereby reducing such contribution as they choose to make.

The remuneration of those reaching this historic agreement is of course funded by taxes.

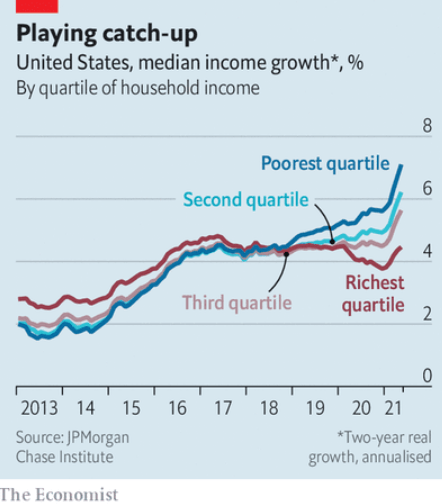

The Rich Failing to Get Richer but the Poor ?

One longstanding and popular, even appealing and logical sounding to many, myth is that some immutable law means that the rich get ever richer while the poor get poorer. While the evidence has, for some 500 years or more, suggested that this is likely to be cute but wrong, the appealing doomsday characteristics of this tale has led to its continued popularity.

The last 8 years or so have shown that for the US at least, a more balanced state of affairs seems to exist in respect of growth.

The rate of growth in median income for the poorest quartile in the US is now just on twice that of the the rate experienced by the richest. Back in 2017 the numbers were similar across the divide, while in 2013 growth rates favoured the rich. As ever seems to be the case the melodramatic is trumped by observed data. For those in the poorest quartile that is good news just as it may be bad news for the attention seekers in so many media.