Archive

The Rich Failing to Get Richer but the Poor ?

One longstanding and popular, even appealing and logical sounding to many, myth is that some immutable law means that the rich get ever richer while the poor get poorer. While the evidence has, for some 500 years or more, suggested that this is likely to be cute but wrong, the appealing doomsday characteristics of this tale has led to its continued popularity.

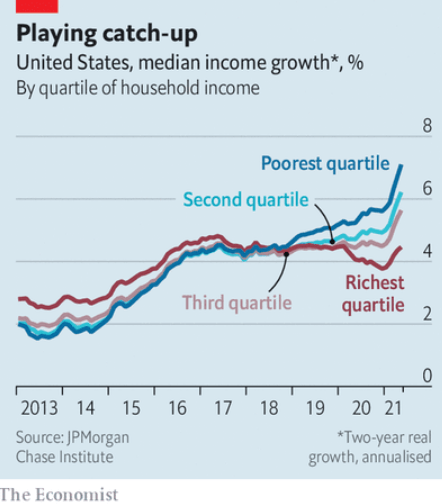

The last 8 years or so have shown that for the US at least, a more balanced state of affairs seems to exist in respect of growth.

The rate of growth in median income for the poorest quartile in the US is now just on twice that of the the rate experienced by the richest. Back in 2017 the numbers were similar across the divide, while in 2013 growth rates favoured the rich. As ever seems to be the case the melodramatic is trumped by observed data. For those in the poorest quartile that is good news just as it may be bad news for the attention seekers in so many media.

One Ring to Rule them All is Often Suboptimal

Watching those having the unenviable task of deciding whether or not school students should return to school as we try to learn how to manage covid in a “non elimination” world, a striking constraint is the fact that in an education system where there is but one approach which has to be applied (more or less) uniformly to all education, through one system utterly dominated by one “Ministry” and one set of institutional settings options is needlessly limiting.

As time marches on and the pandemic unfolds what is clear is that there is remarkable diversity in the nature and form of exposure and risk scattered through myriad communities in quite different geographies, demographic character, exposure profiles, vaccination states and vulnerability status. Successful management is most likely to reflect nuance, adaptability, wide variation and scope for a dynamic approach.

A set of institutional settings that is founded at its very heart on a “make one size fit all” dictate is likely to be overly dictatorial, inflexible, capable of generating conflict and inadequate – almost by definition. A centralised template is most likely more of a hindrance than a help. Greater reliance on the capacity of communities to develop their own solutions has a good deal to offer that is swept away in pursuing central dictate as a way forward.

Cross Branding

While this sort of approach is not entirely new, this take is fairly bold:

Lexus and Fender have created a Stratocaster electric guitar inspired by the Lexus LC flagship.

From a musicians point of view, something of an extension of the “guitars for lawyers and Doctors” trend… the music is yet to be heard.

Experts Going Off-Piste May be Unhealthy

One of the more dangerous phenomena identified by those working in economics and the cognitive behavioural domain in recent years is the “Halo Effect”. This refers to situations in which expectations of the success and wisdom of those having expertise, experience, skill and success – perhaps even notoriety – in a given field such as sport, medicine, politics, art, mathematics, company management, politics or indeed any particular reasonably well defined arena is unjustifiably extended into other unrelated fields. This seems to be common.

Thus it is not uncommon to find All Blacks professing expertise in selecting the best garage door to buy, actresses promising longer, wrinkle free lives for all, and celebrities in almost any field lauding the benefits of goods, services and behaviours unrelated to their core knowledge and expertise.

There may be some underlying generic attributes which justify an element of this. Characteristics such as determination, energy, passion, dedication to an objective might be examples. However in a number of cases the halo reaching well beyond its originating point seems far fetched and unlikely to emanate from any serious basis for favourable compariuson.

At present we appear to suffer this problem in the health area. Expertise in epidemiology for example would seem no basis for predicting likely human behaviour in the light of public policy initiatives, significant success in diagnosis and treatment of various health conditions is not necessarily a crucial component in understanding behaviour patterns of groups or crowds or even individuals.

Prediction of economic outcomes and behaviour patterns in particular off the back of medical or public health expertise is likely a doomed enterprise subject, at the very least, to risks of enhancing uncertainty, offering inappropriate levels of risk aversity, ignoring critical factors (such as the relevant opportunity costs) and failing to come to grips with risk management optimisation or the need to avoid absolutes as benchmarks when desirable outcomes are inextricably bound up with comparative assessment.

A more sound approach then is for experts to “stay within their circle of competence” to quote Warren Buffett, and in particular refrain from making attention earning or seeking, melodramatic assertions regarding “problems” and their “solution”.

Cost of Capital in the December Quarter

Estimation is currently challenging…. as it ever is!

A few points and my current (as always subject to the Rev. Bayes) estimate for N.Z.:

- the estimate is always expectational

- most important not to get overly side tracked by the short run

- most important not to confuse Govt “policy attempts” to set prices with what may happen

Thus I note:

Riskfree rate? 5 year govt stock may still be the best rough long run approximation. Say 4%

Equity Risk Premium (Rm – Rf)? Damodaran option estimate after tax and sovereign risk adjusted 4.7%

This gives us 8.7% as a market post investor tax based cost of equity capital for NZ. Say 9%.

For those interested in WACC, recent Commerce Commission work suggests that the average premium for corporate debt might be in the order of 2% at present, and observation of the NZX50 suggests a debt to total capital ratio of around 38%

When Financial Economics and Music Collide

In the late 80s it was popular amongst the more buttoned down and starchy of my investment banker and legal colleagues to be fairly sniffy about what were termed “buyout firms” which designed and implemented leveraged takeover bids for underperforming companies then seeking to re-structure, lift performance and add value to often moribund under performers with lazy balance sheets and extensive empires.

A favourite (and not always popular) LBO firm of mine, expert in this area, was Kohlberg, Kravis Roberts or KKR. Their first high profile success was a bid for RJR Nabisco. Management had made a bid to buy RJR for some $66 a share. A competitive bidding process ensued with KKR, eventually winning control of the company for $129 a share – a 95% premium on management’s claim of what was “fair value”.

The company was taken private and a total overhaul, including sale of the company’s management air travel fleet – known colloquially as the “RJR Airforce”. Once performing well – some three years later – RJR was floated again and that, at a significant premium to the $129 a share KKR paid. Consolidation of assets, management and a ruthless focus on customers had served to both add significant value to owners and for customers.

Much more recently another American icon, Gibson Guitars, whose products helped drive two generations of blues, rock, fusion and jazz and a bevy of household name guitar heroes (including, yes, purveyors of the unmentionable “Stairway”) to fame lost touch with its customers. Quality control was poor and pricing strategies were so bad that Gibson’s became known as “guitars for doctors and lawyers”. A travesty to us musicians and cause of much hand wringing.

Not a recipe for success and bankruptcy followed.

Enter my favourites – KKR. The company was bought by KKR (now regarded as a seasoned and respectable – or at least more respectable “Private Equity” firm) and a new CEO, formerly of Levi Strauss and a guitar enthusiast as well as turnaround manager was installed. A significant turnaround was implemented – quality improved, costly but failing innovation attempts were abandoned and pricing was re-worked to realistic levels.

The resulting recovery and success was accelerated by lockdown driven demand from Covid responses (home grown guitarist numbers soared), and currently demand outstrips supply by a heathy margin.

Lessons aplenty. Focus on shareholders is critical and the primary means to add value for shareholders is through satisfying all elements of customer demand in a comprehensive fashion.

And of course….. don’t be sniffy.

Making no difference outside of harm…

Matt Ridley in the Daily Mail:

It is almost tragi-comic that this crisis is happening while Boris Johnson is in New York, futilely trying to persuade an incredulous world to join us in committing eco self-harm by adopting a rigid policy of net zero by 2050 – a target that is almost certainly not achievable without deeply hurting the British economy and the lives of ordinary people, and which will only make the slightest difference to the climate anyway, given that the UK produces a meagre 1 per cent of global emissions.

As for the middle-class Extinction Rebellion poseurs and their road-closing chums from Insult Britain, sorry Insulate Britain, they are basing their apocalyptic predictions of ‘catastrophe’ and billions of deaths on gross exaggerations.

And while preventing working people earning a livelihood may make them feel good, it does nothing to solve the real problem of climate change.

LondonJazzCollector

Next to reading and, I suppose gardening, “collecting” must be close to the top of leisure activities. Who collects what, why and how defies categorisation but some characteristics seem to be common. A certain obsession, tenacity, unpredictability, enthusiasm, stubborn persistence – and, usefully if randomly, items of great interest to the non collecting free rider. In short, significant amounts of value are at times added for low cost.

Such is the case with the LondonJazzCollector

This is a wonderful treasure drove of quasi fanatical detail covering “Adventures in collecting “modern jazz: the classical music of America from the Fifties and Sixties, on original vinyl, on a budget, from England.”

A pleasure to read, moments of enjoyment for the casual passer by and a serious jazz resource. Not to be missed.

Demography is Your Destiny

Satisfying Labels are Indeed Dangerous

Frequently it seems, we are inclined to rush for “satisfying” labels such as “racism”, “bigotry”, “chauvinism”, “foreigner”, or, even more dangerously “inequity”, when a little attention to demography offers a simple, understandable and surprisingly strong explanation for things we don’t understand at first glance.

Vaccination rates may well be a case in point. Noticing that vaccination rates amongst Maori and Pacific communities have been lower than amongst the wider population there has been no shortage of “influencers” and experts pointing to all sorts of labels which carry vast amounts of political and emotional freight to “explain” why this would be.

Yet these communities have different age structures to the wider population often with an over representation of the young in them. Vaccines were not even released for younger age groups until well after the older age groups (the 65+ sub groups) had had them available for a good while. The release for age groups was staggered (for various reasons having little or nothing to do with ethnicity) over a significant period.

Thus the arithmetic and the calendar tells us a good deal more about the difference in rates than melodramatic statements and labels.

The danger arises because once some phenomena is safely relegated to its satisfying “ism” then listening stops, exploration for better explanation stops, emotionally charged or ratings driven behaviour abounds and lessons are not learned.

That is no way to improve our welfare. It is also pointlessly wrong and unpleasant.

Next Quarter: Daylight Not Cash Saving

ASB expects: We expect the OCR to move up soon. Our forecasts have 50bps of OCR hikes by the end of the year and assume a historically low OCR endpoint of 1.50% by late 2022. Mortgage interest rates have already been on the move and look set to continue to climb. We envisage a historically low peak in average mortgage interest rates this cycle. How will moderately higher interest rates impact the household sector? There are 3 channels:

1) House prices – higher mortgage interest rates should sharply slow housing market momentum, with prices largely expected to flatline over 2022.

2) Economic activity – the gradual pace of OCR hikes that we envisage is unlikely to derail the economic expansion and so shouldn’t significantly weigh on household incomes and employment.

3) Cashflow – The average mortgage rate for housing lending of just under 3%, a record low, which has bolstered household debt servicing. NZ households are net borrowers from financial institutions, so an increase in customer interest rates will reduce household cashflows. Our estimates suggest a 100bp increase in customer interest rates will reduce household cashflows by roughly $2.6bn per annum, approximately 1% of household disposable incomes. It’s not immaterial, but our assessment is that the increase in debt servicing costs should be manageable for most households. Borrowers with large debt exposures will clearly fell the cashflow hit. Some will struggle.